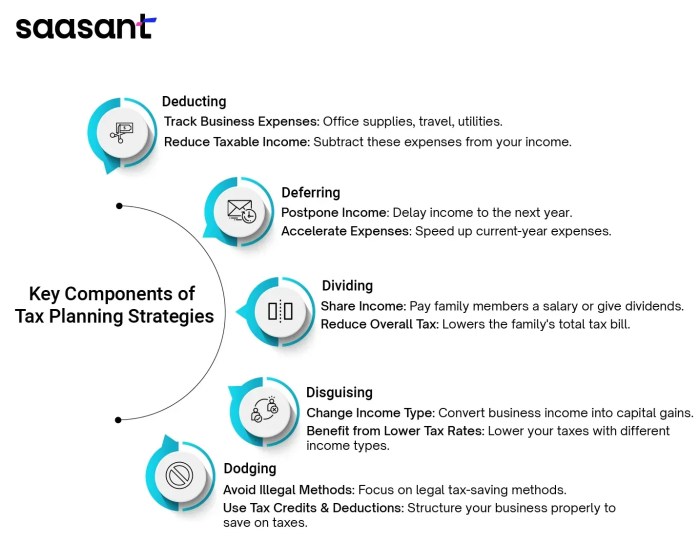

Tax planning strategies for business owners set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. From the importance of tax planning to common deductions, and tax-efficient business structures to retirement planning, this guide explores the intricate world of tax strategies for business owners.

Importance of Tax Planning for Business Owners

Effective tax planning is crucial for business owners as it can help maximize profits, minimize tax liabilities, and ensure compliance with tax laws and regulations. By strategically planning their taxes, business owners can optimize their financial resources and make informed decisions that benefit their business in the long run.

Benefits of Effective Tax Planning

- Reduced tax liabilities: Through careful planning, business owners can take advantage of tax deductions, credits, and incentives to lower their tax burden.

- Improved cash flow: By managing tax payments efficiently, business owners can free up cash flow for investments, expansion, or operational needs.

- Legal compliance: Proper tax planning helps business owners stay compliant with tax laws, avoiding penalties, fines, or legal issues.

- Strategic decision-making: Understanding the tax implications of business decisions allows owners to make informed choices that align with their financial goals.

Consequences of Not Having a Tax Planning Strategy

- Higher tax bills: Without a tax planning strategy, business owners may end up paying more taxes than necessary, reducing their profitability.

- Cash flow challenges: Poor tax planning can lead to cash flow issues, affecting the business's ability to meet financial obligations or invest in growth opportunities.

- Legal risks: Non-compliance with tax laws can result in costly audits, fines, or legal consequences that harm the business's reputation and financial stability.

Common Tax Deductions and Credits for Business Owners

When it comes to maximizing tax savings, business owners have access to a variety of deductions and credits that can help reduce their tax liability. By taking advantage of these opportunities, business owners can keep more of their hard-earned money and reinvest it back into their business.

Key Deductions for Business Owners

- Business Expenses: Deductible expenses include rent, utilities, office supplies, and marketing costs.

- Vehicle Expenses: Deduct mileage or actual expenses related to business use of a vehicle.

- Home Office Deduction: If you use part of your home exclusively for business, you may be able to deduct related expenses.

- Employee Benefits: Contributions to employee health insurance and retirement plans are often deductible.

Tax Credits for Business Owners

- Research and Development Tax Credit: Encourages businesses to invest in innovation and development.

- Small Business Health Care Tax Credit: Helps small businesses afford health insurance for their employees.

- Work Opportunity Tax Credit: Offers incentives for hiring employees from certain targeted groups.

Proper documentation is crucial when claiming deductions and credits. Business owners should keep detailed records of expenses, receipts, and other relevant documents to support their claims in case of an audit. By staying organized and understanding the tax benefits available, business owners can effectively manage their tax obligations and keep more money in their pockets.

Tax-Efficient Business Structures

When it comes to tax planning for business owners, choosing the right business structure is crucial. Different business structures have varying tax implications, and selecting the most tax-efficient one can greatly impact your overall tax strategy.

Comparison of Business Structures

- Sole Proprietorship: A sole proprietorship is the simplest form of business structure, where the business and the owner are considered one entity. The owner reports business income on their personal tax return and is taxed at individual tax rates.

- LLC (Limited Liability Company): An LLC offers liability protection for owners and can choose how they want to be taxed - as a sole proprietorship, partnership, S-Corp, or C-Corp. This flexibility allows for tax optimization based on the business's needs.

- S-Corporation: An S-Corp is a pass-through entity where business income is passed through to the shareholders, who report it on their individual tax returns. This structure can help business owners lower their self-employment taxes.

Optimizing Tax Planning Strategies

Choosing the right business structure can optimize tax planning strategies in various ways

Importance of Periodically Reviewing Business Structure

It's essential for business owners to periodically review and possibly change their business structure for tax efficiency. As the business grows or tax laws change, a different structure may become more beneficial. Consulting with a tax professional can help ensure that your business structure aligns with your tax planning goals.

Retirement Planning and Tax Deferral Strategies

Retirement planning is a crucial aspect of financial management for business owners, not only for securing their future but also for minimizing tax liabilities. By investing in retirement accounts, business owners can take advantage of tax-deferral strategies to reduce their taxable income and ultimately pay less in taxes.

Retirement Account Options for Business Owners

- 401(k): A popular retirement account option that allows business owners to contribute a portion of their income on a pre-tax basis. Contributions grow tax-deferred until withdrawal during retirement, potentially lowering current tax obligations.

- SEP-IRA (Simplified Employee Pension Individual Retirement Account): Ideal for self-employed individuals and small business owners, SEP-IRA contributions are tax-deductible, providing a way to save for retirement while reducing taxable income.

Contributing to retirement accounts not only helps business owners save for the future but also offers immediate tax benefits. By lowering taxable income through contributions, business owners can potentially reduce their tax liabilities and keep more of their hard-earned money.

Tax Planning for Business Expansion and Investments

When it comes to expanding your business or making investments, tax planning plays a crucial role in maximizing your profits and minimizing tax liabilities. By strategizing effectively, you can take advantage of various tax incentives and deductions, ultimately boosting your bottom line.

Strategies for Minimizing Taxes

One effective strategy for minimizing taxes during business expansion is to utilize tax credits and deductions offered by the government. By conducting thorough research and staying updated on tax laws, you can identify opportunities to reduce your tax burden.

- Explore tax credits for hiring employees from certain demographics or investing in specific industries.

- Consider accelerated depreciation methods to write off the cost of assets more quickly.

- Utilize tax-deferred investment accounts to grow your funds without immediate tax implications.

Tax Implications of Different Business Investments

It's essential to understand the tax implications of different types of business investments to make informed decisions that align with your tax planning goals.

| Investment Type | Tax Implications |

|---|---|

| Real Estate | May qualify for depreciation deductions and capital gains tax rates. |

| Stocks and Bonds | Capital gains tax may apply based on investment holding period. |

| Business Expansion | Potential deductions for expansion costs and tax credits for job creation. |

Impact of Timing on Tax Consequences

The timing of your business expansion and investments can significantly impact the tax consequences you face. By strategically planning the timing of your financial activities, you can optimize your tax position.

- Delaying the sale of assets until the next tax year could result in lower capital gains tax rates.

- Timing the purchase of equipment towards the end of the year may allow you to claim depreciation deductions sooner.

- Accelerating expenses before year-end can reduce taxable income for the current year.

Final Conclusion

In conclusion, navigating the realm of tax planning as a business owner requires foresight, strategy, and a keen understanding of the financial landscape. By implementing these strategies, business owners can optimize their financial efficiency, minimize tax liabilities, and pave the way for sustainable growth and success.

Frequently Asked Questions

Can tax planning really make a difference for my business?

Yes, effective tax planning can significantly impact your business by reducing tax liabilities, increasing cash flow, and optimizing financial resources.

What are some commonly overlooked tax deductions for business owners?

Some overlooked deductions include home office expenses, business travel costs, and professional development expenses.

How can business owners ensure proper documentation for tax deductions and credits?

Keeping detailed records of expenses, maintaining receipts, and working with a professional accountant can help in ensuring proper documentation for tax purposes.

Is it advisable to change my business structure for better tax efficiency?

Periodically reviewing and potentially changing your business structure can be beneficial for optimizing tax planning strategies based on evolving business needs and financial goals.