Embark on a journey to discover the ins and outs of managing business cash flow effectively. From understanding the importance of cash flow management to exploring strategies for improvement, this topic delves into crucial aspects that can make or break a business.

Delve deeper into the realm of cash flow optimization and monitoring tools to gain valuable insights that can propel your business towards financial success.

Importance of managing cash flow

Effective cash flow management is crucial for the sustainability of a business. It involves monitoring the flow of money in and out of the company to ensure there is enough liquidity to cover expenses, debts, and investments. Without proper cash flow management, businesses can quickly find themselves in financial trouble, unable to pay bills or take advantage of growth opportunities.

Potential consequences of poor cash flow management

- Difficulty meeting financial obligations: Inability to pay suppliers, employees, or lenders on time can damage relationships and lead to legal action.

- Missed growth opportunities: Lack of available funds can prevent businesses from investing in new projects, expanding operations, or seizing market opportunities.

- Increased debt: Relying on credit to cover cash shortfalls can lead to a cycle of borrowing and interest payments, putting strain on the business's finances.

- Risk of insolvency: Persistent cash flow problems may ultimately result in bankruptcy, as the business becomes unable to sustain its operations.

Positive impact of effective cash flow management

- Improved financial health: Monitoring cash flow allows businesses to identify inefficiencies, reduce costs, and optimize revenue streams, leading to better overall financial performance.

- Enhanced decision-making: Having a clear picture of cash flow enables businesses to make informed decisions about investments, expenses, and growth strategies.

- Stability and growth: Positive cash flow provides the necessary capital to fund day-to-day operations, pursue expansion opportunities, and weather economic downturns, ensuring the long-term success of the business.

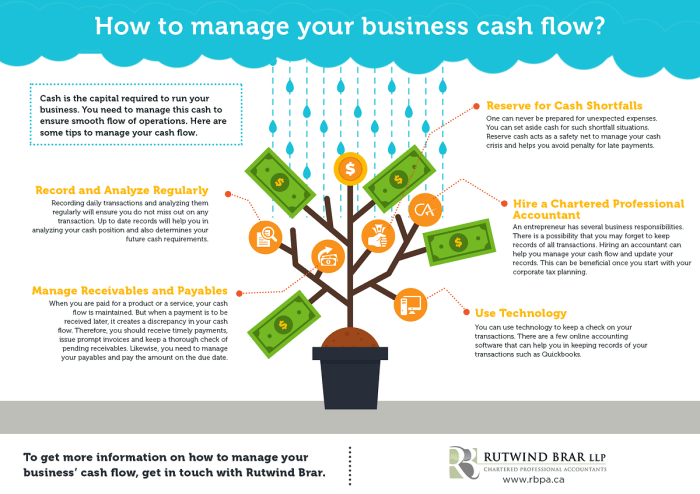

Strategies to improve cash flow

Effective management of cash flow is crucial for the success of any business. Implementing strategies to improve cash flow can help ensure financial stability and growth. Here are some key tips to enhance cash flow:

Accelerate accounts receivable collections

One way to improve cash flow is to expedite the collection of accounts receivable. This can be achieved by sending out invoices promptly, following up with clients on outstanding payments, and offering incentives for early payment. By reducing the time it takes to receive payments, businesses can increase their available cash flow.

Negotiate better payment terms with suppliers

Negotiating favorable payment terms with suppliers can also help improve cash flow. By extending payment deadlines or requesting discounts for early payment, businesses can better manage their cash flow and avoid unnecessary strain on their finances. Building strong relationships with suppliers can lead to more flexible terms that benefit both parties.

Cash flow forecasting

Cash flow forecasting involves predicting future cash inflows and outflows to anticipate potential financial challenges and opportunities. By creating accurate forecasts, businesses can proactively manage their finances, identify potential cash shortages, and make informed decisions to optimize cash flow. Utilizing cash flow forecasting tools and regularly reviewing financial projections can help businesses stay on track and maintain a healthy cash flow.

Cash flow monitoring tools

Managing cash flow effectively is crucial for the financial health of a business. Utilizing cash flow monitoring tools can help businesses track and analyze their cash flow in real-time, allowing for better decision-making. Let's explore some popular software tools that can assist businesses in monitoring their cash flow.

Popular Cash Flow Monitoring Tools

- Xero: Xero is a cloud-based accounting software that offers features for invoicing, payroll, inventory management, and cash flow tracking. It provides real-time insights into cash flow and financial performance.

- QuickBooks Online: QuickBooks Online is another popular accounting software that offers cash flow tracking features. It allows businesses to create cash flow projections, monitor expenses, and analyze financial reports.

- Wave: Wave is a free accounting software that includes cash flow monitoring tools. It helps businesses track income and expenses, generate financial reports, and manage invoices.

Comparing Cash Flow Monitoring Tools

| Tool | Key Features | Pricing |

|---|---|---|

| Xero | Real-time cash flow insights, inventory management, payroll | Subscription-based pricing |

| QuickBooks Online | Cash flow projections, expense tracking, financial reports | Subscription-based pricing |

| Wave | Income and expense tracking, financial reports, invoicing | Free with optional paid add-ons |

Features to Look for in Cash Flow Monitoring Tools

- Real-time cash flow insights: Ensure the tool provides real-time updates on cash flow to make informed decisions.

- Expense tracking: Look for tools that allow tracking and categorizing of expenses to monitor cash outflows.

- Financial reporting: Choose tools that offer customizable financial reports to analyze cash flow trends and performance.

- Invoicing and payment tracking: Consider tools with invoicing features to manage cash inflows and track outstanding payments.

Cash flow optimization techniques

Effective cash flow management involves optimizing various strategies to ensure the smooth operation of your business. By implementing the following techniques, you can enhance your cash flow and maintain financial stability.

Reducing unnecessary expenses

One of the key ways to improve cash flow is by identifying and cutting down on unnecessary expenses. Conduct a thorough review of your operational costs and prioritize essential expenditures. By eliminating non-essential items or services, you can free up additional funds that can be allocated towards more critical areas of your business.

Offering discounts for early payments

Encouraging your customers to pay invoices promptly can significantly impact your cash flow. Consider offering discounts or incentives for early payments to incentivize clients to settle their accounts sooner. This practice can help accelerate your receivables turnover and provide a steady influx of cash into your business.

Cash reserves and their importance

Maintaining adequate cash reserves is crucial for managing cash flow effectively. By setting aside a portion of your revenue for emergencies or unexpected expenses, you can safeguard your business against financial uncertainties. Cash reserves act as a safety net during lean periods and ensure that you have the resources to cover essential costs without relying on external sources of funding.

Ultimate Conclusion

In conclusion, mastering the art of managing business cash flow effectively is key to ensuring the financial health and stability of your enterprise. By implementing the strategies and techniques discussed, you can navigate the challenges of cash flow management with confidence and precision.

Essential FAQs

How can I improve my accounts receivable collections?

To accelerate accounts receivable collections, consider offering discounts for early payments and implementing efficient invoicing systems.

Why is cash flow forecasting important?

Cash flow forecasting helps businesses anticipate financial trends, plan for future expenses, and ensure smooth operations even during lean periods.

What are cash reserves and why are they important?

Cash reserves are funds set aside to cover unexpected expenses or emergencies, providing a buffer against cash flow disruptions and ensuring financial stability.