How to Choose a Shopify Capital Loan for Your Ecommerce Growth

How to Choose a Shopify Capital Loan for Your Ecommerce Growth sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality.

Exploring the different loan options available for Shopify businesses, assessing business needs, understanding eligibility criteria, and the impact of loan terms on growth are just the beginning of this insightful journey.

Factors to Consider When Choosing a Shopify Capital Loan

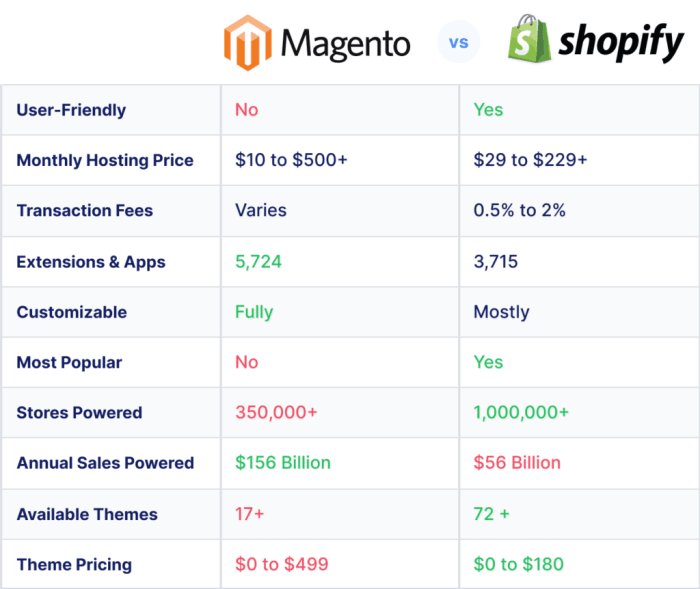

When looking for a Shopify capital loan to fuel your ecommerce growth, there are several key factors to keep in mind to ensure that you make the best decision for your business.It's important to first understand the different types of loans available for Shopify businesses.

Whether it's a traditional term loan, a line of credit, or a merchant cash advance, each type of loan comes with its own set of terms and conditions that can impact your business in different ways.Assessing your business needs is crucial before selecting a loan.

Consider factors such as the amount of capital required, the purpose of the loan, and your ability to repay it. This will help you determine the most suitable loan option for your specific situation.Eligibility criteria for a Shopify capital loan can vary depending on the lender.

Typically, factors such as your business's revenue, credit score, and time in operation will be taken into consideration. Make sure to review these criteria carefully to ensure that you meet the requirements before applying.The terms of the loan you choose can have a significant impact on your business growth.

For example, a longer repayment term may result in lower monthly payments but higher overall interest costs. On the other hand, a shorter term may mean higher monthly payments but lower total interest expenses. Consider how these terms align with your business goals and financial capabilities to make an informed decision.

Researching Loan Options for Ecommerce Growth

When it comes to expanding your ecommerce business, finding the right loan provider is crucial. Researching loan options for Shopify businesses involves comparing various factors to ensure you make the best choice for your business's growth.

Comparing Interest Rates and Repayment Terms

Before deciding on a loan provider, it's essential to compare interest rates and repayment terms offered by different lenders. This comparison will help you understand the total cost of the loan and how it will impact your business's finances in the long run.

- Compare the interest rates offered by different providers to choose the most competitive option.

- Consider the repayment terms, including the duration of the loan and any flexibility in payment schedules.

- Calculate the total amount to be repaid, including interest, to determine the affordability of the loan.

Evaluating Credibility and Reputation of Loan Providers

Ensuring the credibility and reputation of the loan provider is essential to protect your business and finances. Here are some tips to evaluate the trustworthiness of potential lenders:

- Check for reviews and testimonials from other Shopify businesses that have worked with the lender.

- Look for accreditations or certifications that indicate the lender follows industry best practices.

- Verify the lender's credentials and licenses to operate as a legitimate financial institution.

Leveraging Online Resources for Finding the Best Loan Options

With the vast amount of information available online, you can leverage various resources to find the best loan options for your ecommerce growth:

Utilize comparison websites to see side-by-side comparisons of different loan providers and their offerings.

- Explore online forums and communities where business owners share their experiences with different lenders.

- Consult financial experts or advisors who can provide insights into the best loan options for ecommerce businesses.

- Research industry reports and analyses to understand trends in ecommerce financing and identify top loan providers.

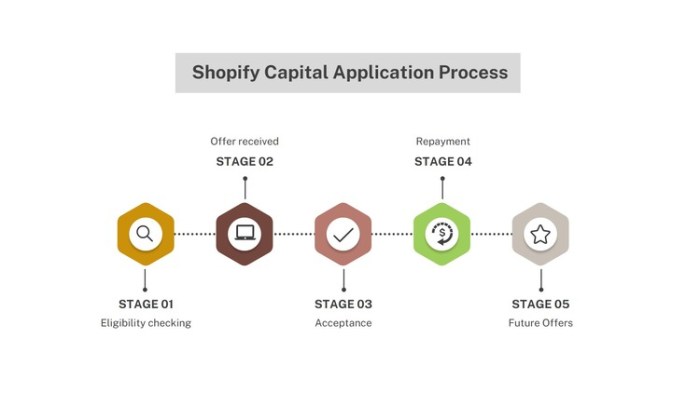

Understanding the Application Process for Shopify Capital Loans

When it comes to applying for a Shopify capital loan, understanding the process is crucial to ensure a smooth and successful application. Here is a breakdown of the typical application process, documentation required, importance of a solid business plan, and tips to streamline the process.

Typical Application Process

- Start by logging into your Shopify account and navigating to the capital section.

- Fill out the application form with details about your business, revenue, and loan amount.

- Submit the application and wait for a decision from Shopify Capital within a few days.

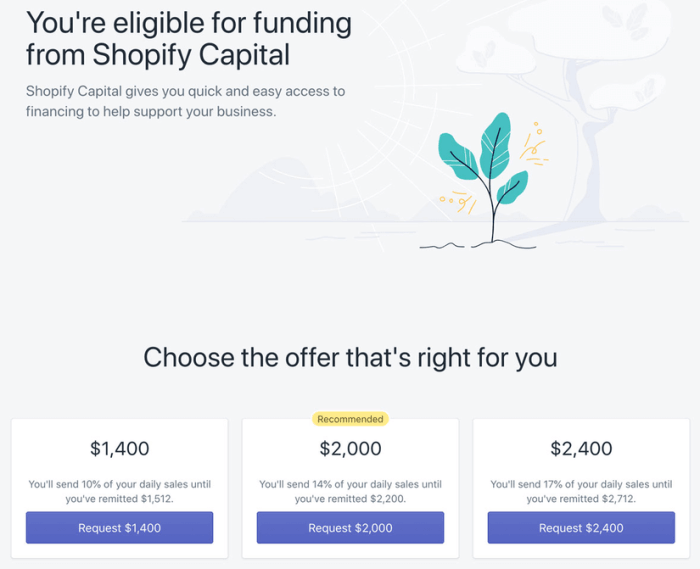

- If approved, review the terms and conditions and accept the loan offer.

- Funds are then deposited into your business account for immediate use.

Documentation Required

- Business information such as address, contact details, and legal structure.

- Financial documents like bank statements, tax returns, and revenue reports.

- Identification documents for the business owner(s) such as driver's license or passport.

- Any additional documents requested by Shopify Capital during the application process.

Importance of a Solid Business Plan

A solid business plan is essential when applying for a Shopify capital loan as it demonstrates to lenders that you have a clear vision for your business and a strategy for growth. It should include details on your target market, competition, financial projections, and how you plan to use the loan funds to achieve your goals.

Tips to Streamline the Loan Application Process

- Organize all required documentation in advance to expedite the application process.

- Ensure your financial records are up to date and accurate to strengthen your application.

- Be prepared to answer any additional questions or provide more information if requested by Shopify Capital.

- Communicate openly and honestly with Shopify Capital to address any concerns or queries promptly.

Managing Loan Repayments for Ecommerce Success

Managing loan repayments effectively is crucial for the success of your ecommerce business. By understanding the different repayment structures available for Shopify capital loans and implementing strategies to handle repayments, you can ensure the financial health of your business.

Different Repayment Structures

- Fixed Payments: With fixed payments, you will pay a set amount each month, making it easier to budget and plan for repayments.

- Revenue-based Payments: These payments fluctuate based on your ecommerce store's sales, allowing for flexibility during slower months.

- Balloon Payments: A larger payment is due at the end of the loan term, which can help lower monthly payments but requires careful financial planning.

Strategies for Effective Repayment

- Track Cash Flow: Monitor your revenue and expenses closely to ensure you can meet repayment obligations.

- Create a Repayment Plan: Develop a repayment schedule and stick to it to avoid missing payments.

- Automate Payments: Set up automatic payments to avoid late fees and ensure timely repayments.

Impact of Timely Repayments

Timely repayments can positively impact your business by improving your credit score, building trust with lenders, and potentially qualifying you for larger loan amounts in the future. Additionally, it can help you avoid penalties and fees, ultimately saving you money in the long run.

Handling Unexpected Financial Challenges

- Emergency Fund: Set aside funds to cover unexpected expenses or revenue fluctuations that may impact your ability to make repayments.

- Communication with Lenders: If you anticipate financial difficulties, communicate with your lender to explore alternative repayment options or solutions.

- Seek Financial Assistance: Consider seeking financial advice or support from professionals to navigate unexpected challenges effectively.

Conclusion

As we come to the end of this discussion on How to Choose a Shopify Capital Loan for Your Ecommerce Growth, remember that careful research, thorough understanding of the application process, and effective management of loan repayments are key to achieving success in your ecommerce venture.

Frequently Asked Questions

What types of loans are available for Shopify businesses?

There are various types of loans such as short-term loans, merchant cash advances, and business lines of credit that Shopify businesses can explore.

What documentation is typically required when applying for a Shopify capital loan?

Documentation usually includes business financial statements, tax returns, business plans, and proof of ownership.

How can timely repayments positively impact my business?

Timely repayments can help build a good credit history, improve your business's financial health, and potentially open doors to more financing opportunities in the future.