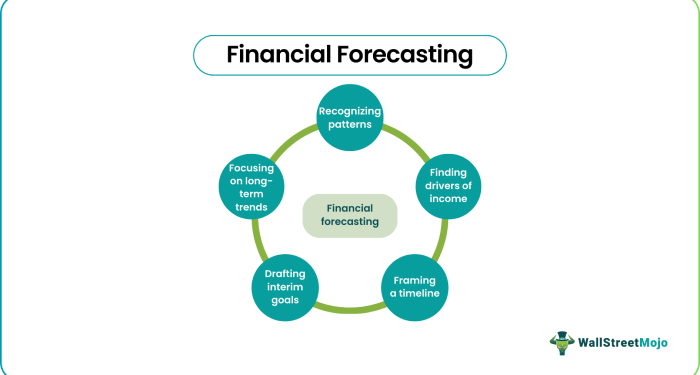

Exploring the realm of financial forecasting and its impact on business growth, this introduction sets the stage for a deep dive into a crucial aspect of strategic decision-making.

Financial forecasting plays a pivotal role in shaping the future trajectory of businesses, providing insights that go beyond mere numbers and charts.

Importance of Financial Forecasting

Financial forecasting plays a crucial role in the growth and success of a business. By predicting future financial outcomes, businesses can make informed decisions and set realistic goals to drive their growth strategies.

Strategic Decision-Making

Financial forecasting helps businesses in making strategic decisions by providing insights into potential financial challenges and opportunities. By analyzing projected financial data, companies can identify areas for improvement, allocate resources effectively, and plan for future investments.

- Forecasting cash flow enables businesses to manage working capital efficiently, ensuring they have enough liquidity to cover expenses and seize growth opportunities.

- Predicting revenue growth helps companies set sales targets, develop marketing strategies, and adjust pricing strategies to maximize profitability.

- Anticipating expenses and budgeting accurately allows businesses to control costs, improve operational efficiency, and maintain profitability.

Competitive Advantage

Accurate financial forecasting can give businesses a competitive advantage by enabling them to adapt quickly to changing market conditions and outperform competitors.

For example, a retail company that accurately forecasts consumer demand can adjust its inventory levels, pricing, and marketing strategies to meet customer needs effectively, leading to increased sales and market share.

- Forecasting future financial performance helps businesses identify growth opportunities, expand into new markets, and make strategic investments to stay ahead of the competition.

- By predicting potential financial risks and challenges, companies can develop contingency plans, mitigate threats, and ensure long-term sustainability and growth.

Types of Financial Forecasts

Financial forecasting plays a crucial role in helping businesses plan for the future and make informed decisions. There are different types of financial forecasts that businesses utilize to manage their operations effectively. Let's delve into the specifics of short-term and long-term financial forecasts, sales forecasting, and cash flow forecasting.

Short-Term vs. Long-Term Financial Forecasts

Short-term financial forecasts typically cover a period of up to one year and are focused on immediate financial goals and objectives. These forecasts help businesses monitor their day-to-day operations, manage working capital, and make short-term adjustments to ensure financial stability.

On the other hand, long-term financial forecasts extend beyond one year and provide a strategic view of the business's financial health over an extended period. Long-term forecasts are essential for long-range planning, budgeting, and investment decisions.

Sales Forecasting in Financial Planning

Sales forecasting is a critical component of financial planning as it helps businesses estimate future sales revenue based on historical data, market trends, and other factors. By accurately predicting sales figures, businesses can better allocate resources, set realistic targets, and identify potential growth opportunities.

Sales forecasting also enables businesses to anticipate fluctuations in demand, adjust pricing strategies, and optimize inventory management.

Cash Flow Forecasting for Managing Business Operations

Cash flow forecasting involves projecting the inflows and outflows of cash within a specified period, typically on a monthly or quarterly basis. By forecasting cash flow, businesses can anticipate cash shortages or surpluses, plan for upcoming expenses, and make informed decisions to maintain liquidity.

Cash flow forecasting is essential for managing working capital, securing financing, and ensuring the financial stability of the business.

Benefits of Financial Forecasting

Financial forecasting provides numerous benefits for businesses, helping them make informed decisions and plan for the future effectively.

Risk Management

Financial forecasting plays a crucial role in risk management by allowing businesses to anticipate potential financial challenges and mitigate risks. By forecasting future revenues, expenses, and cash flows, companies can identify potential cash flow shortages, market fluctuations, or economic downturns.

This enables businesses to implement strategies to minimize risks and ensure financial stability.

Resource Allocation

Forecasting also assists in resource allocation by providing insights into future financial needs. By accurately predicting revenue streams and expenses, businesses can allocate resources efficiently to areas that require investment or cost-cutting measures. This ensures that resources are utilized effectively, maximizing profitability and operational efficiency.

Setting Realistic Business Goals

Financial forecasting aids in setting realistic business goals by providing a clear picture of the company's financial health and performance. By analyzing financial projections, businesses can set achievable targets and milestones based on data-driven insights. This helps in monitoring progress, making informed decisions, and adjusting strategies to achieve long-term success.

Tools and Techniques for Financial Forecasting

Financial forecasting relies on a variety of tools and techniques to help businesses make informed decisions about their future financial performance. Let's explore some key methods that are commonly used in the process.

Use of Historical Data

Historical data plays a crucial role in creating accurate financial forecasts. By analyzing past financial performance, trends, and patterns, businesses can identify key drivers and variables that impact their future revenue and expenses. This data serves as a foundation for developing realistic projections and estimates for the future.

Role of Forecasting Software

Forecasting software has revolutionized the financial forecasting process by automating complex calculations, data analysis, and scenario modeling. These tools help streamline the forecasting process, improve accuracy, and provide real-time insights into the potential financial outcomes of various business decisions. With forecasting software, businesses can quickly generate multiple scenarios and assess the impact of different variables on their financial performance.

Scenario Analysis

Scenario analysis is a powerful tool for creating more robust financial forecasts. By developing multiple scenarios based on different assumptions and variables, businesses can evaluate the potential outcomes of various strategic decisions. This allows companies to anticipate risks, plan for contingencies, and make more informed decisions to optimize their financial performance.

Scenario analysis helps businesses prepare for uncertainty and adapt to changing market conditions, ultimately improving their overall financial forecasting accuracy.

Challenges in Financial Forecasting

Financial forecasting can be a powerful tool for business planning, but it is not without its challenges. Businesses often face common pitfalls when trying to predict their financial future. External factors can also have a significant impact on the accuracy of financial forecasts.

Overcoming these challenges is crucial for businesses to make informed decisions and achieve their growth objectives.

Identifying Common Pitfalls

- Inaccurate data input: Using incorrect or outdated data can lead to flawed forecasts.

- Overlooking external factors: Failure to consider external economic conditions, market trends, or regulatory changes can result in inaccurate predictions.

- Ignoring seasonality: Failing to account for seasonal fluctuations in sales or expenses can lead to misleading forecasts.

- Lack of expertise: Insufficient knowledge or experience in financial forecasting can hinder the accuracy of predictions.

Impact of External Factors

- Market volatility: Sudden changes in the market can disrupt forecasts, especially for industries sensitive to external economic conditions.

- Regulatory changes: New laws or regulations can impact financial projections, requiring businesses to adapt their forecasts accordingly.

- Competitive landscape: Actions taken by competitors can influence market dynamics and affect the accuracy of forecasts.

Strategies to Overcome Challenges

- Improve data quality: Ensure data used for forecasting is accurate, up-to-date, and relevant to the business.

- Utilize scenario analysis: Develop multiple scenarios based on different assumptions to account for uncertainties and mitigate risks.

- Engage experts: Seek advice from financial professionals or consultants to enhance the accuracy of forecasts and gain valuable insights.

- Regularly review and adjust forecasts: Continuously monitor actual performance against forecasts and make necessary adjustments to improve future predictions.

Ending Remarks

In conclusion, financial forecasting emerges as not just a tool for predicting numbers but a strategic compass guiding businesses towards sustainable growth and success.

FAQ Section

How can financial forecasting help in risk management?

Financial forecasting allows businesses to anticipate potential risks and take proactive measures to mitigate them, thereby enhancing overall risk management strategies.

What is the role of sales forecasting in financial planning?

Sales forecasting helps businesses estimate future revenues, enabling effective financial planning and budgeting to support growth initiatives.

Why is cash flow forecasting important in managing business operations?

Cash flow forecasting provides businesses with insights into their liquidity position, allowing them to manage day-to-day operations, investments, and expenditures more effectively.