In the realm of global finance, small businesses face a myriad of challenges and opportunities. From currency fluctuations to advances in technology, the landscape is constantly evolving. Let's delve into how these trends are shaping the future of small businesses worldwide.

Impact of global economic trends on small businesses

Global economic trends have a significant impact on small businesses, affecting their operations, profitability, and overall success. Here are some key ways in which these trends influence small businesses:

Fluctuations in Currency Exchange Rates

Changes in currency exchange rates can have a direct impact on small businesses that engage in international trade. When the value of a country's currency increases or decreases relative to other currencies, it can affect the cost of imported goods and services, as well as the competitiveness of exported products.

Small businesses may face higher costs for imported materials or products, leading to reduced profit margins or increased prices for consumers.

Changes in Interest Rates

Shifts in interest rates can also impact small businesses, particularly in terms of borrowing costs. When interest rates rise, small businesses may face higher costs when taking out loans or lines of credit. This can make it more challenging for small businesses to access capital for expansion or operations, potentially limiting their growth opportunities.

Global Economic Recessions

During economic recessions, consumer spending patterns tend to change, which can directly impact small businesses. Consumers may cut back on discretionary spending, leading to lower sales for small businesses. Additionally, during recessions, small businesses may face challenges accessing credit or financing, further constraining their ability to grow or sustain operations.

International trade policies and their effects on small businesses

International trade policies play a crucial role in shaping the business landscape for small businesses around the world. The decisions made by governments regarding tariffs, trade agreements, and regulations can have a significant impact on the operations and profitability of small businesses that engage in international trade.

Impact of tariffs and trade agreements

Tariffs are taxes imposed on imported goods, making them more expensive for businesses to purchase. Small businesses that rely on imported goods for their operations may face increased costs due to tariffs, which can ultimately affect their bottom line. On the other hand, trade agreements can lower or eliminate tariffs, making it easier and more affordable for small businesses to import goods from other countries.

Effects of trade wars

Trade wars, characterized by escalating tariffs and retaliatory measures between countries, can create a challenging environment for small businesses that depend on imports or exports. The uncertainty and volatility caused by trade wars can disrupt supply chains, increase costs, and reduce market access for small businesses, impacting their competitiveness and profitability.

Changes in trade regulations

Changes in trade regulations can present both opportunities and challenges for small businesses looking to expand globally

Adapting to these changes and staying informed about evolving trade regulations is essential for small businesses seeking to navigate the complexities of international trade.

Technology advancements shaping financial practices for small businesses

Digital payment systems have transformed the way small businesses conduct financial transactions, making payments faster, more secure, and more convenient. Online banking and financial management tools have also played a crucial role in streamlining operations for small businesses, providing real-time access to financial data and enabling better decision-making.

Automation and AI are revolutionizing financial analysis and forecasting for small businesses, allowing for more accurate predictions and insights to drive growth and success.

Impact of Digital Payment Systems

Digital payment systems have significantly improved the efficiency of financial transactions for small businesses. With the ability to accept payments online, businesses can expand their customer base and reach a wider audience. Additionally, digital payment systems offer secure and reliable payment processing, reducing the risk of fraud and ensuring seamless transactions.

Online Banking and Financial Management Tools

Online banking and financial management tools have made it easier for small businesses to manage their finances effectively. These tools provide instant access to account information, facilitate quick transfers, and enable businesses to track expenses and revenue in real-time. By leveraging online banking and financial management tools, small businesses can optimize their cash flow and make informed financial decisions.

Automation and AI in Financial Analysis

Automation and AI technologies are transforming financial analysis and forecasting for small businesses. By automating repetitive tasks and leveraging AI algorithms, businesses can gain valuable insights into their financial performance and make data-driven decisions. These technologies can help small businesses identify trends, predict future outcomes, and optimize their financial strategies for sustainable growth.

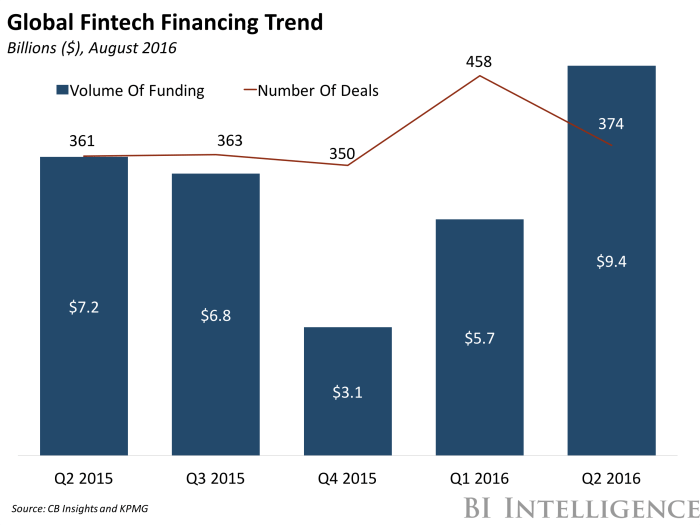

Access to capital and financing options for small businesses in a global economy

In a global economy, small businesses face challenges when it comes to accessing capital and finding suitable financing options. It is crucial for these businesses to explore various sources of funding beyond traditional bank loans to support their growth and development.

Crowdfunding vs. Venture Capital

- Crowdfunding: Crowdfunding platforms allow small businesses to raise capital from a large number of individual investors. This option can be beneficial for businesses that have a strong online presence and a compelling story to attract investors.

- Venture Capital: Venture capital involves raising funds from investors in exchange for equity in the business. While venture capital can provide substantial funding, it often comes with giving up a portion of ownership and decision-making control.

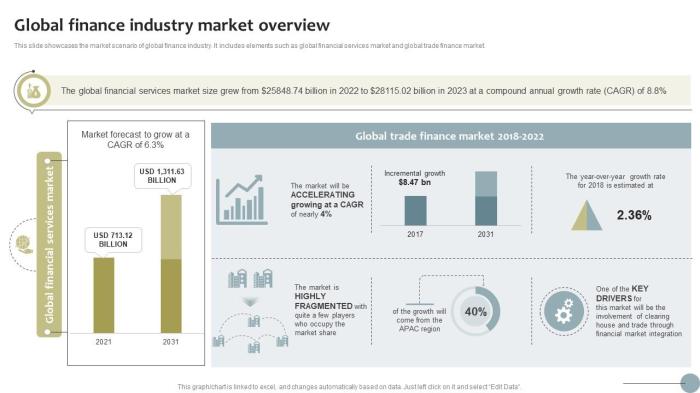

Role of Global Financial Institutions

- IMF and World Bank: Global financial institutions like the International Monetary Fund (IMF) and the World Bank play a significant role in influencing financing options for small businesses in developing countries. They provide financial assistance, technical support, and policy advice to help improve access to capital for small businesses in these regions.

Last Word

As we wrap up our discussion on global finance trends impacting small businesses, it's evident that adaptability and foresight are key for success in this dynamic environment. By staying informed and embracing innovation, small businesses can navigate these trends with confidence and resilience.

Answers to Common Questions

How do fluctuations in currency exchange rates affect small businesses internationally?

Fluctuations in currency exchange rates can impact small businesses by altering the cost of imported goods and potentially affecting profit margins.

What are the advantages and disadvantages of crowdfunding versus venture capital for small businesses?

Crowdfunding allows for raising funds from a large pool of investors, but it may lack the expertise and network that venture capital firms provide.

How do digital payment systems improve small businesses' financial transactions?

Digital payment systems streamline the payment process, enhance security, and provide convenience for both businesses and customers.

How do global financial institutions like the IMF or World Bank influence financing options for small businesses in developing countries?

Global financial institutions can offer funding programs, technical assistance, and policy advice to support small businesses in developing countries.