Delving into the world of finance management for ecommerce businesses, this guide aims to shed light on the importance of effective financial strategies tailored for online operations.

Navigating through key financial challenges and planning techniques, this exploration will equip entrepreneurs with the knowledge needed to make informed decisions in the dynamic realm of ecommerce.

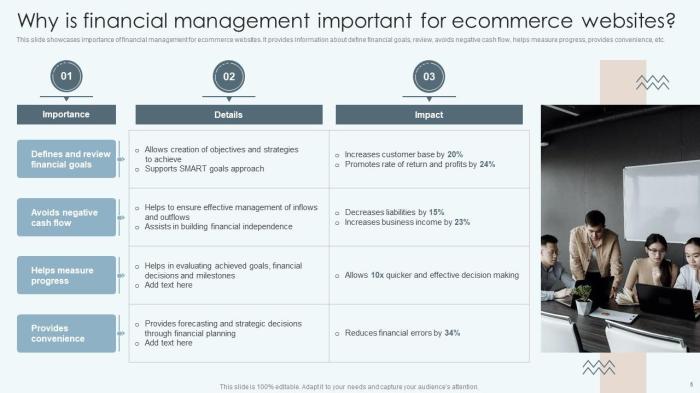

Importance of Finance Management for Ecommerce Businesses

Effective finance management is crucial for the success of ecommerce businesses as it directly impacts profitability, cash flow, and overall financial health. Proper management of finances allows businesses to allocate resources efficiently, plan for growth, and make informed decisions to optimize performance.

Key Financial Challenges in Ecommerce Operations

- Managing cash flow: Ecommerce businesses often face fluctuations in sales volume, leading to unpredictable cash flow. Proper financial management helps in forecasting cash flow and ensuring there is enough liquidity to cover expenses.

- Inventory management: Balancing inventory levels to meet demand without tying up too much capital in excess stock is a common challenge. Effective finance management can help in optimizing inventory levels and reducing carrying costs.

- Payment processing fees: Ecommerce businesses incur fees for online payment processing, which can eat into profit margins. By analyzing payment options and negotiating better rates, businesses can mitigate this financial challenge.

Improving Decision-Making Processes in Ecommerce

- Financial data analysis: Proper finance management provides valuable insights through financial reports and analysis, enabling businesses to make data-driven decisions. This includes identifying profitable products, optimizing pricing strategies, and assessing the impact of marketing campaigns.

- Budgeting and forecasting: Setting realistic budgets and forecasts based on accurate financial data helps ecommerce businesses plan for growth, allocate resources effectively, and monitor performance against set targets.

- Risk management: By understanding financial risks such as fraud, chargebacks, or market fluctuations, ecommerce businesses can implement strategies to mitigate these risks and protect their bottom line.

Financial Planning for Ecommerce Businesses

Financial planning is crucial for the success of any ecommerce business. It involves setting goals, creating a budget, and monitoring financial performance to ensure long-term sustainability and growth.

Steps in Creating a Financial Plan for an Ecommerce Business

- Set Financial Goals: Define specific and measurable financial objectives for your ecommerce business.

- Develop a Budget: Estimate your revenue, expenses, and cash flow to determine a realistic budget.

- Monitor Performance: Regularly review financial reports and key performance indicators to track progress towards your goals.

- Adjust Strategies: Analyze variances and make necessary adjustments to your financial plan to stay on track.

Comparison of Traditional vs. Modern Financial Planning Methods

- Traditional Methods: Focus on historical data and manual processes, often limited in scalability and efficiency.

- Modern Approaches: Utilize technology, automation, and real-time data analysis for more accurate forecasting and decision-making.

Financial Planning Tools and Software for Ecommerce Businesses

- Ecommerce Platforms: Many platforms offer built-in financial tracking and reporting features to help manage sales, expenses, and inventory.

- Accounting Software: Tools like QuickBooks or Xero can streamline financial processes, including invoicing, payroll, and tax preparation.

- Financial Dashboards: Platforms like LivePlan or Fathom provide visual representations of key financial metrics for better insights and decision-making.

Budgeting Strategies for Ecommerce Operations

Developing a budget that aligns with the goals and growth plans of an ecommerce business is crucial for long-term success. By setting aside funds for key areas like marketing, inventory management, and technological upgrades, businesses can ensure they are well-positioned to adapt to changing market conditions and scale their operations effectively.

Importance of Setting Aside Funds

Setting aside funds for marketing is essential to drive customer acquisition and retention. Allocating a portion of the budget towards inventory management helps prevent stockouts and ensures timely order fulfillment. Additionally, earmarking funds for technological upgrades enables businesses to stay competitive by investing in the latest tools and systems.

Tips for Adjusting Budgets

- Monitor sales trends: Keep a close eye on seasonal fluctuations in ecommerce sales to identify patterns and adjust budgets accordingly.

- Flexible budgeting: Build flexibility into the budget to accommodate unforeseen expenses or opportunities that may arise throughout the year.

- Data-driven decisions: Use data analytics to make informed decisions about budget adjustments based on performance metrics and market trends.

- Review regularly: Regularly review and assess the budget to ensure it remains aligned with business goals and objectives.

Cash Flow Management in Ecommerce

Maintaining a healthy cash flow is vital for the success of ecommerce businesses. Cash flow management involves monitoring the flow of cash in and out of the business to ensure there is enough liquidity to cover expenses and investments.

Strategies for Managing Cash Flow Effectively

- Monitor cash flow regularly: Keep track of incoming and outgoing cash to identify any potential issues or trends.

- Implement cash flow forecasting: Predict future cash flow to anticipate any shortages or surpluses.

- Negotiate favorable payment terms: Work with suppliers and vendors to extend payment terms, allowing more time to manage cash flow.

- Control expenses: Review and reduce unnecessary expenses to free up cash for essential operations.

- Diversify revenue streams: Explore multiple income sources to stabilize cash flow and reduce dependency on a single channel.

Analyzing Cash Flow Statements for Improvement

Understanding cash flow statements is crucial for identifying areas that need improvement in an ecommerce business. By analyzing these statements, businesses can pinpoint where cash is coming from and going to, allowing for strategic decision-making.

Analyze operating, investing, and financing activities to determine the sources and uses of cash within the business.

Compare cash flow from previous periods to track changes and trends that may impact future cash flow.

Identify any discrepancies between cash flow and profit to address potential issues in managing cash effectively.

Ultimate Conclusion

In conclusion, mastering the art of finance management in ecommerce is not just about numbers—it's about strategically positioning your business for sustainable growth and success. By implementing the right tools and strategies, businesses can thrive in the competitive landscape of online commerce.

Detailed FAQs

How can effective finance management impact the success of an ecommerce business?

Effective finance management can ensure that resources are allocated efficiently, leading to improved profitability and sustainable growth for ecommerce businesses.

What are some key financial challenges specific to ecommerce operations?

Key challenges include managing cash flow fluctuations, handling inventory turnover effectively, and navigating the complexities of online payment processing.

How can ecommerce businesses adjust budgets based on seasonal fluctuations in sales?

Ecommerce businesses can adjust budgets by forecasting sales trends, setting aside reserves for slow seasons, and optimizing marketing strategies to capitalize on peak periods.