Cheap Small Business Insurance That Doesnt Cut Corners: A Comprehensive Guide

Embark on a journey through the realm of affordable small business insurance that prioritizes quality over cutting corners. From understanding the importance of insurance to avoiding pitfalls, this guide covers it all.

Delve into the key factors, learn how to balance cost and coverage, and discover red flags to steer clear of when choosing insurance for your small business.

Understanding Small Business Insurance

Small business insurance is essential for protecting your business from unexpected events that could result in financial loss. It provides coverage for various risks that can impact your business operations, assets, and employees.

Types of Insurance Coverage for Small Businesses

There are several types of insurance coverage that small businesses should consider:

- General Liability Insurance: Protects your business from lawsuits related to bodily injury, property damage, and advertising injury.

- Property Insurance: Covers damage to your business property, including buildings, equipment, and inventory, due to fire, theft, or other covered perils.

- Business Interruption Insurance: Provides coverage for lost income and operating expenses if your business is unable to operate due to a covered event.

- Workers' Compensation Insurance: Required in most states, this insurance covers medical expenses and lost wages for employees injured on the job.

- Professional Liability Insurance: Also known as errors and omissions insurance, this coverage protects your business from claims of negligence or inadequate work.

Risks of Operating Without Insurance

Operating a business without insurance can expose you to significant risks, including:

- Financial Loss: Without insurance, your business may be unable to recover from unexpected events such as lawsuits, property damage, or business interruptions.

- Lack of Legal Protection: Insurance provides legal protection and defense in the event of lawsuits, helping to cover legal expenses and settlements.

- Damage to Reputation: Failing to have adequate insurance coverage can damage your business's reputation and credibility, impacting customer trust and loyalty.

Key Factors in Cheap Small Business Insurance

When searching for affordable small business insurance, it is crucial to consider several key factors to ensure you get the best coverage at a reasonable price. Here are some essential factors to keep in mind:

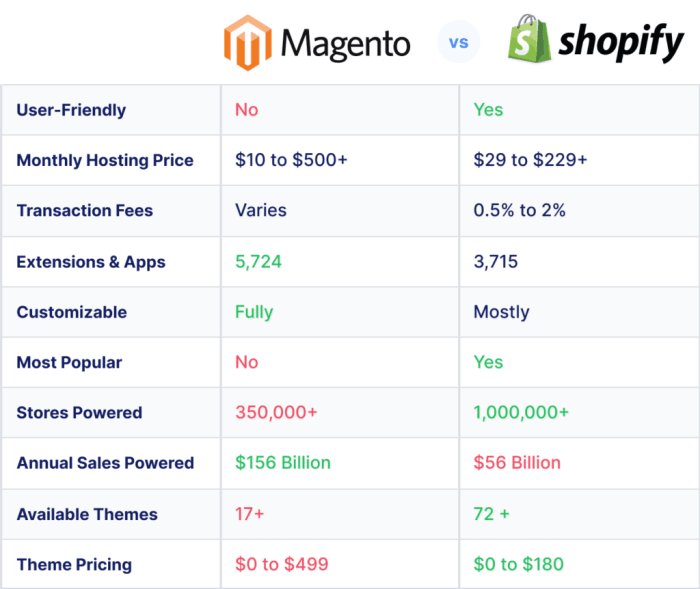

Comparison of Insurance Providers

- Research and compare different insurance providers to find cost-effective plans that meet your business needs.

- Look for insurers that specialize in small business insurance to get tailored coverage at competitive rates.

- Consider the reputation and financial stability of the insurance company to ensure they can fulfill their obligations in case of a claim.

Customizing Insurance Coverage

- Assess your business risks and customize your insurance coverage accordingly to avoid paying for unnecessary coverage.

- Consider bundling different types of insurance, such as general liability and property insurance, to save money on premiums.

- Opt for higher deductibles to lower your premiums, but make sure you can afford the out-of-pocket costs in case of a claim.

Avoiding Pitfalls

When it comes to small business insurance, cutting corners can have serious consequences. It's important to identify red flags that indicate a policy might not provide adequate coverage for your business. Opting for cheap insurance now could lead to significant financial risks in the long run.

Signs of Cut-Corner Insurance

- Low coverage limits: Some cheap insurance policies offer minimal coverage limits that may not be sufficient to protect your business in case of a major incident.

- Exclusions and limitations: Watch out for policies that have many exclusions or limitations, as they may leave your business vulnerable to certain risks.

- Unreliable insurance company: Choosing an insurance provider with a poor reputation or questionable financial stability could result in difficulties when filing claims.

Consequences of Inadequate Coverage

- Financial loss: Without proper coverage, your business could face significant financial losses in the event of a lawsuit, property damage, or other unforeseen circumstances.

- Legal issues: Inadequate insurance coverage may expose your business to legal risks, such as lawsuits or regulatory fines.

- Reputation damage: A lack of insurance coverage could harm your business's reputation and credibility, impacting customer trust and loyalty.

Financial Risks of Cheap Insurance

- Underinsurance: Opting for cheap insurance may result in being underinsured, leaving your business vulnerable to potentially devastating financial losses.

- Hidden costs: Some cheap insurance policies may come with hidden costs or fees that could add up over time, negating any initial cost savings.

- Lack of support: Cheap insurance providers may offer limited customer support or claims assistance, making it challenging to navigate the insurance process when needed.

Balancing Cost and Coverage

Finding the right balance between cost and coverage is crucial when selecting a small business insurance policy. It's essential to ensure that your business is adequately protected while also keeping expenses manageable.

Negotiating with Insurance Providers

When negotiating with insurance providers, it's important to be knowledgeable about your business's specific needs and risks. By providing accurate information about your operations, you can work with the provider to tailor a policy that meets your requirements without unnecessary coverage that could drive up costs.

Remember, insurance providers are often willing to negotiate on premiums and deductibles to secure your business.

- Research different insurance providers to compare quotes and coverage options.

- Consider bundling multiple insurance policies with the same provider for potential discounts.

- Discuss your risk management strategies with the provider to potentially lower premiums.

Maximizing Benefits while Minimizing Expenses

To maximize insurance benefits while minimizing expenses, it's essential to regularly review and adjust your coverage based on your business's evolving needs. By staying informed about industry trends and risks, you can make informed decisions about your insurance coverage to ensure you are adequately protected without overpaying.

Regularly reassess your coverage needs and adjust your policy accordingly to avoid underinsurance or overpaying for unnecessary coverage.

- Work with a knowledgeable insurance agent who can help you navigate the complexities of small business insurance.

- Consider implementing risk management strategies to reduce the likelihood of claims and potentially lower insurance premiums.

- Review your policy annually to ensure it aligns with your current business operations and risks.

Final Summary

In conclusion, finding cheap small business insurance that doesn't compromise on protection is crucial for the financial health of your business. By following the insights and tips provided, you can secure the right coverage without breaking the bank.

Questions Often Asked

What factors should I consider when looking for affordable small business insurance?

Consider the coverage needed, the reputation of the insurance provider, and any customization options available.

How can I balance cost and coverage when selecting a policy?

Design a strategy that prioritizes essential coverage while seeking out cost-effective plans and negotiating for the best deal.

What are the consequences of choosing inadequate insurance coverage for a small business?

Opting for insufficient coverage can leave your business vulnerable to financial risks in the long run, potentially leading to significant losses.