Embarking on the journey of Business finance strategies for startups, this introduction aims to provide a captivating overview of the essential financial strategies crucial for the success of new businesses.

Delving deeper into the realm of financial planning and budgeting, this guide explores the intricate details of managing finances for sustainable growth.

Importance of Business Finance Strategies for Startups

Having solid financial strategies is crucial for the success of startups as it helps in managing resources efficiently, making informed decisions, and ensuring long-term sustainability.

Impact of Good vs Poor Financial Planning

Good financial planning can lead to growth, profitability, and scalability for startups, while poor financial planning can result in cash flow issues, bankruptcy, and ultimately failure.

Key Financial Challenges Faced by Startups

- Lack of Capital: Startups often struggle with limited funding, making it challenging to cover initial expenses and invest in growth.

- Uncertain Revenue Streams: Fluctuating revenue can make it difficult to forecast cash flow and budget effectively.

- High Burn Rate: Startups may have high expenses relative to revenue, leading to cash depletion and financial instability.

- Access to Funding: Securing financing from investors or lenders can be challenging for startups, affecting their growth potential.

Types of Business Finance Strategies

When it comes to financing their operations, startups have several strategies to choose from. These strategies can vary in terms of risk, control, and potential for growth. Let's delve into some of the most common types of business finance strategies utilized by startups.

Bootstrapping

Bootstrapping is a strategy where entrepreneurs fund their business using personal savings or revenue generated by the business itself. This approach allows startups to maintain full control over their business without taking on any external debt or giving up equity.

While bootstrapping can help startups maintain independence, it may limit their ability to scale quickly due to the lack of external funding.

Venture Capital

Venture capital involves raising funds from investment firms or wealthy individuals in exchange for equity in the startup. This type of financing is often used by startups with high growth potential but may require giving up a significant portion of ownership and control.

Venture capital can provide startups with the capital needed to scale rapidly and enter new markets.

Angel Investors

Angel investors are individuals who provide capital to startups in exchange for ownership equity or convertible debt. Unlike venture capital firms, angel investors are typically high-net-worth individuals who invest their own money. This type of financing can be less formal and more flexible than venture capital, making it a popular choice for early-stage startups.

Debt Financing vs. Equity Financing

Debt financing involves borrowing money that must be repaid over time, usually with interest. This can come in the form of bank loans, lines of credit, or bonds. On the other hand, equity financing involves selling a stake in the company to investors in exchange for capital.

While debt financing allows startups to retain full ownership, equity financing dilutes ownership but does not require repayment.

Pros and Cons

- Debt Financing:Pros include lower cost compared to equity financing, interest payments are tax-deductible, and no dilution of ownership. However, cons include the obligation to repay the debt, potential for high interest rates, and risk of default.

- Equity Financing:Pros include no repayment obligation, access to expertise and networks of investors, and shared risk. Cons include loss of control and ownership, sharing profits with investors, and potential conflicts of interest.

Financial Planning and Budgeting

Financial planning and budgeting are crucial aspects of managing the finances of a startup. By creating a comprehensive financial plan and effectively budgeting, startups can ensure sustainability and growth in the long run.

Creating a Comprehensive Financial Plan

Creating a comprehensive financial plan involves several steps that startups should follow:

- Assess the current financial situation: Start by analyzing the current financial status of the startup, including income, expenses, assets, and liabilities.

- Set financial goals: Define clear and achievable financial goals that align with the overall business objectives.

- Develop a budget: Create a detailed budget that Artikels projected revenues and expenses for a specific period, usually a year.

- Monitor and adjust: Regularly monitor the financial performance of the startup and make necessary adjustments to stay on track with the financial plan.

Effective Budgeting for Startups

Effective budgeting is essential for startups to manage their finances efficiently. Here are some tips for startups to budget effectively:

- Identify key expenses: Prioritize essential expenses and allocate funds accordingly to ensure operational stability.

- Forecast cash flow: Estimate incoming and outgoing cash flow to prevent cash shortages and plan for future financial needs.

- Control costs: Implement cost-saving measures and monitor expenses to avoid overspending.

- Review and revise: Regularly review the budget and make adjustments as needed to optimize financial resources.

Importance of Financial Forecasting

Financial forecasting plays a vital role in startup business finance strategies. It helps startups predict future financial outcomes and make informed decisions. By forecasting revenues, expenses, and cash flow, startups can anticipate challenges and opportunities, enabling them to plan effectively for sustainable growth.

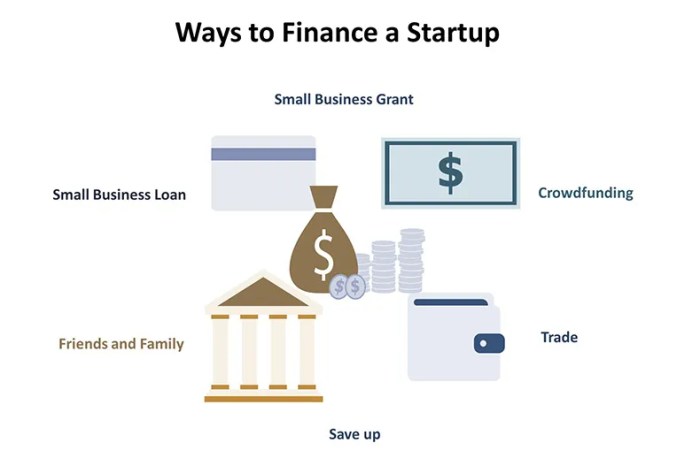

Funding Sources for Startups

When it comes to funding sources for startups, there are several options available that entrepreneurs can explore to finance their ventures. It is essential for startups to carefully consider the criteria for each funding source to determine the most appropriate one for their specific needs.

Crowdfunding

Crowdfunding has gained popularity as a funding source for startups in recent years. This method involves raising small amounts of money from a large number of people, typically through online platforms. Startups can showcase their business idea and attract potential investors who believe in their vision.

Grants

Grants are another funding option for startups, especially for those in sectors like technology, healthcare, and social entrepreneurship. These are non-repayable funds provided by governments, non-profit organizations, or corporations to support innovative projects that align with their objectives.

Accelerators

Accelerators are programs that offer funding, mentorship, and resources to startups in exchange for equity. These programs typically run for a fixed period, during which startups receive support to accelerate their growth and development.

Criteria for Choosing Funding Sources

When choosing the most appropriate funding source, startups should consider factors such as the amount of funding required, the stage of their business, the level of control they are willing to give up, and the potential growth opportunities offered by the source.

Advantages and Disadvantages of Funding Options

- Crowdfunding:

- Advantages: Access to a wide pool of investors, validation of business idea, potential for early customer acquisition.

- Disadvantages: Time-consuming to run a campaign, risk of not reaching funding goal, competition with other projects on crowdfunding platforms.

- Grants:

- Advantages: Non-repayable funds, credibility boost from receiving grants, support for research and development.

- Disadvantages: Limited availability, specific eligibility criteria, reporting requirements.

- Accelerators:

- Advantages: Funding, mentorship, networking opportunities, access to resources and expertise.

- Disadvantages: Equity dilution, pressure to meet program milestones, limited duration of support.

Concluding Remarks

Concluding our discussion on Business finance strategies for startups, it is evident that a solid financial foundation is the cornerstone of any successful venture. By implementing effective strategies and carefully planning finances, startups can navigate the challenges and thrive in the competitive business landscape.

Frequently Asked Questions

What are some key financial challenges faced by startups?

Startups often struggle with cash flow management, securing funding, and setting realistic financial goals.

How can startups effectively budget their finances?

Startups can track expenses, prioritize spending, and regularly review and adjust their budgets to ensure financial stability.

What is the difference between debt financing and equity financing for startups?

Debt financing involves borrowing money that needs to be repaid with interest, while equity financing involves exchanging ownership stakes in the company for capital.

What are some common funding sources available to startups?

Startups can explore options like crowdfunding, angel investors, venture capital, and accelerators to secure funding for their business.