In the realm of global commerce, having the right accounting software can make all the difference. From managing multi-currency transactions to ensuring data security and compliance, the world of international business requires specialized tools. Let's delve into the key aspects of the best accounting software for international businesses, exploring essential features, integration capabilities, and more.

Overview of Accounting Software for International Businesses

Accounting software for international businesses is designed to meet the complex needs of companies operating globally. These software solutions offer features such as multi-currency support, multi-language capabilities, and compliance with international accounting standards.Using specialized accounting software for global operations is crucial for ensuring accurate financial reporting, managing diverse tax regulations, and streamlining cross-border transactions.

It helps businesses maintain consistency in financial processes across different locations, improve efficiency, and reduce the risk of errors.

Examples of Popular Accounting Software for International Businesses

- Oracle Netsuite: A cloud-based solution that provides real-time visibility into financial data, inventory management, and order processing for businesses with global operations.

- SAP Business One: Offers integrated financial management, sales, and customer relationship management tools to help international businesses streamline operations and improve decision-making.

- Xero: A user-friendly accounting software with multi-currency support, online invoicing, and bank reconciliation features, suitable for small to medium-sized international businesses.

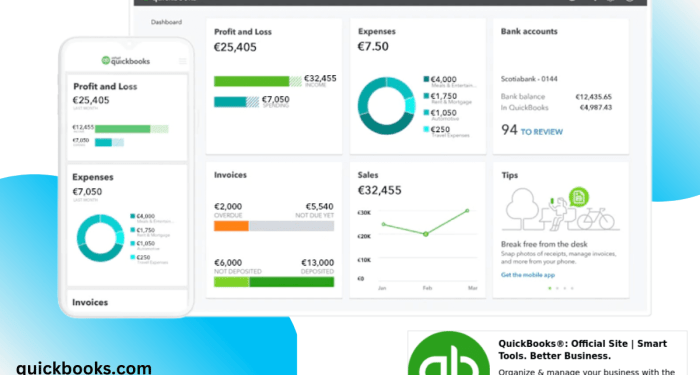

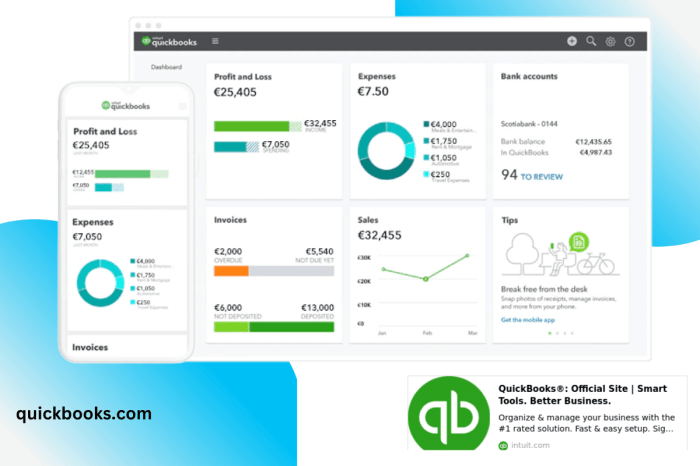

- QuickBooks Online: Enables businesses to manage finances, track expenses, and generate reports in multiple currencies, making it a popular choice for international companies of all sizes.

Key Features to Look for in Accounting Software

When choosing accounting software for international businesses, it is crucial to consider specific features that can streamline financial operations across different countries and currencies. From multi-currency support to multi-language capabilities, here are some key features to look for:

Multi-Currency Support

One of the essential features for accounting software in international businesses is multi-currency support. This feature allows companies to process transactions in various currencies, automatically converting amounts and providing accurate financial reports. It helps in managing international payments, tracking exchange rates, and ensuring compliance with different tax regulations.

Multi-Language Capabilities

Another important feature to consider is multi-language capabilities in accounting software. With global teams working together, it is essential to have a system that supports multiple languages to facilitate communication and collaboration. This feature enables users to input data, generate reports, and communicate in their preferred language, enhancing efficiency and accuracy in financial processes.

Integration Capabilities with Other Business Tools

Having accounting software that integrates seamlessly with other business tools is crucial for international businesses looking to streamline their operations and improve efficiency. This integration allows for a smooth flow of data between different systems, eliminating the need for manual data entry and reducing the risk of errors.

Common Integrations for International Businesses

- Customer Relationship Management (CRM) software: Integration with CRM systems allows for easy access to customer data and financial information in one place, enabling better customer service and more accurate financial reporting.

- Inventory Management software: By integrating accounting software with inventory management systems, businesses can track inventory levels, manage stock, and automatically update financial records when inventory is bought or sold.

- Payment Processing tools: Integrating accounting software with payment processing tools enables businesses to streamline the invoicing and payment process, improving cash flow management and reducing late payments.

Benefits of Automated Data Synchronization

Automated data synchronization between accounting software and other systems offers several benefits for international businesses:

- Increased Efficiency: By automating data synchronization, businesses can save time and reduce the risk of manual errors, allowing employees to focus on more strategic tasks.

- Improved Accuracy: Automated data synchronization ensures that information is consistently updated across all systems, reducing discrepancies and ensuring the accuracy of financial reporting.

- Enhanced Decision-Making: With real-time access to integrated data, businesses can make informed decisions quickly, based on up-to-date financial information and operational data.

Data Security and Compliance Considerations

Data security and compliance are crucial aspects for international businesses when selecting accounting software. Here's how accounting software addresses these considerations:

Importance of Data Security Measures

Maintaining the security of financial data is paramount for international businesses. Accounting software offers features such as data encryption, secure access controls, and regular data backups to safeguard sensitive financial information from unauthorized access or cyber threats.

Maintaining Compliance with Global Regulations

Accounting software helps businesses adhere to various global regulations by automating compliance processes. It ensures accurate financial reporting, tax compliance, and adherence to international accounting standards, reducing the risk of non-compliance penalties or legal issues.

Significance of Data Encryption and Secure Access Controls

Data encryption plays a vital role in protecting financial data during transmission and storage. Secure access controls enable businesses to restrict access to sensitive information based on user roles and permissions, ensuring that only authorized personnel can view or modify financial records.

Epilogue

As we wrap up our exploration of the best accounting software for international businesses, it's clear that choosing the right tool can streamline operations and foster growth on a global scale. By prioritizing features like multi-currency support and data security, businesses can navigate the complexities of international finance with ease.

Question Bank

How important is multi-currency support in accounting software for international businesses?

Multi-currency support is crucial as it allows businesses to accurately track finances in different currencies, simplifying global transactions.

What are common integrations that international businesses may require in accounting software?

Common integrations include CRM systems, payment gateways, and e-commerce platforms to streamline operations.

Why is data security significant in accounting software for international businesses?

Data security is vital to protect sensitive financial information from cyber threats and ensure compliance with global regulations.