A Breakdown of Business General Liability Insurance in 2025: Navigating the Future Landscape

Embarking on a journey through the realm of Business General Liability Insurance in 2025, we delve into a realm where innovation and adaptation shape the insurance industry. Discover how this essential coverage is evolving to meet the needs of companies in a dynamic business environment.

Exploring the key components and significance of this insurance type sets the stage for understanding its pivotal role in safeguarding businesses against potential risks and liabilities.

Overview of Business General Liability Insurance

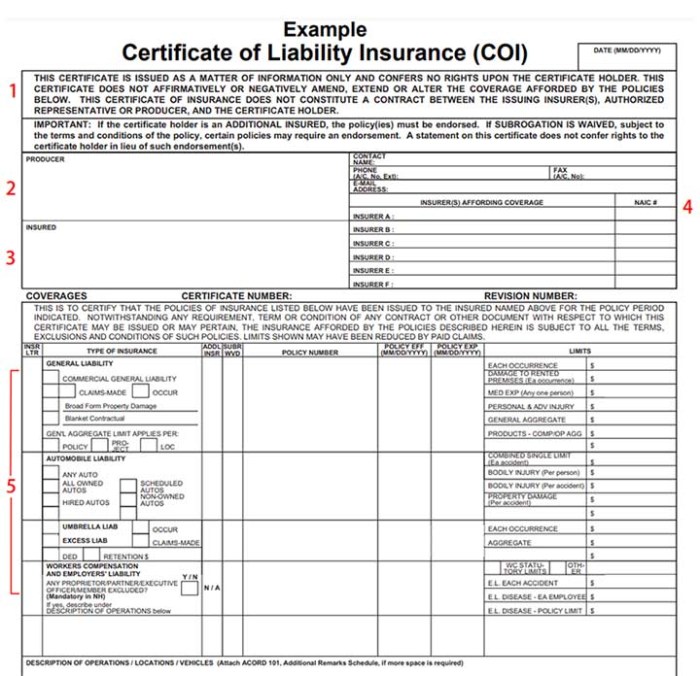

Business general liability insurance is a type of insurance coverage that provides protection to businesses against financial losses resulting from third-party claims of bodily injury, property damage, and advertising injury.

Key Components Covered

- Bodily Injury: This component covers medical expenses and legal costs if a third party is injured on your business premises.

- Property Damage: It covers damage to someone else's property caused by your business operations.

- Advertising Injury: This includes claims of slander, libel, copyright infringement, and other related issues arising from your advertising.

Importance of Having Business General Liability Insurance

Having business general liability insurance is crucial for companies as it provides financial protection and peace of mind in case of unexpected accidents or lawsuits. It helps cover legal defense costs, settlements, and judgments, which can be substantial and potentially devastating for a business without insurance coverage.

Trends and Changes in Business General Liability Insurance by 2025

In the ever-evolving landscape of business general liability insurance, several trends and changes are anticipated by 2025. These shifts are expected to impact the coverage provided and the regulations governing such policies.

Increased Focus on Cyber Liability Coverage

With the rise of cyber threats and data breaches, there is a growing recognition of the need for businesses to have robust cyber liability coverage as part of their general liability insurance. By 2025, it is expected that policies will include more comprehensive cyber protection to safeguard businesses from digital risks.

Expansion of Coverage for Non-Physical Damages

Traditionally, business general liability insurance has primarily covered physical damages or injuries. However, by 2025, there is a predicted expansion in coverage to include non-physical damages such as reputational harm, intellectual property infringement, and other intangible losses that businesses may suffer.

Introduction of Usage-Based Insurance Policies

In line with the growing trend of personalized insurance products, by 2025, there may be an increase in the availability of usage-based insurance policies for businesses. These policies adjust premiums based on specific risk factors and actual usage patterns, offering more tailored coverage options to businesses.

Regulatory Changes to Address Emerging Risks

As new risks emerge in the business landscape, regulators are likely to update the requirements for business general liability insurance by 2025. This could involve stricter guidelines for certain industries, additional compliance measures, or changes in the minimum coverage limits mandated for businesses.

Integration of AI and Data Analytics in Claims Processing

By 2025, advancements in technology are expected to streamline claims processing for business general liability insurance through the integration of artificial intelligence (AI) and data analytics. This could lead to faster claim resolutions, improved accuracy in risk assessment, and enhanced efficiency in the overall insurance process.

Technology Impact on Business General Liability Insurance

The integration of technology into the administration and distribution of business general liability insurance has revolutionized the way insurance companies operate. From streamlining processes to enhancing customer experience, technology plays a crucial role in shaping the future of this type of insurance.

Innovations in Technology for Business General Liability Insurance

- Automation: The use of automated systems and artificial intelligence helps insurance companies process claims faster and more accurately, reducing human error.

- Data Analytics: Insurers can now analyze vast amounts of data to assess risk more effectively and customize insurance policies to meet the specific needs of businesses.

- Blockchain Technology: Blockchain ensures secure and transparent transactions, making it easier for insurers to verify policyholder information and prevent fraud.

Benefits and Challenges of Technological Integration

- Benefits:

- Improved Efficiency: Technology streamlines processes, saving time and reducing costs for insurance companies.

- Enhanced Customer Experience: Digital tools allow for quicker responses to customer inquiries and claims, leading to higher satisfaction levels.

- Better Risk Assessment: Data analytics enable insurers to better understand risks and offer more tailored coverage to businesses.

- Challenges:

- Data Security: With the use of technology comes the risk of data breaches and cyber attacks, requiring insurers to invest in robust cybersecurity measures.

- Adoption Barriers: Some businesses may be resistant to adopting new technologies, posing a challenge for insurers looking to modernize their processes.

- Regulatory Compliance: Insurers must navigate complex regulatory requirements when implementing new technologies to ensure compliance with industry standards.

Environmental Factors Influencing Business General Liability Insurance

Climate change and other environmental issues have a significant impact on the insurance industry, including business general liability insurance. These factors introduce new risks and challenges that insurance companies need to address to stay relevant and sustainable in the long term.

Impact of Climate Change on Business General Liability Insurance

Climate change is leading to an increase in extreme weather events, such as hurricanes, floods, and wildfires. These events can result in property damage, bodily injury, and other liabilities for businesses, ultimately affecting their general liability insurance coverage. Insurance companies may see a rise in claims related to climate-related incidents, leading to higher payouts and potential financial losses.

- Insurance companies may need to reassess their risk models and underwriting practices to account for the growing impact of climate change on businesses.

- Implementing stricter risk management protocols and offering specialized coverage for climate-related risks can help insurance companies mitigate potential losses.

- Collaborating with climate scientists and experts to better understand and anticipate the effects of climate change on businesses can also be beneficial in improving risk assessment and coverage offerings.

Risks Related to Environmental Factors in Business General Liability Insurance

Apart from climate change, other environmental factors like pollution, environmental degradation, and regulatory changes can pose risks to businesses and their general liability insurance coverage. Companies operating in industries with high environmental impact may face increased scrutiny and potential legal liabilities related to environmental damage.

Environmental cleanup costs and legal expenses arising from pollution incidents can be significant liabilities for businesses, impacting their general liability insurance coverage.

- Insurance companies may need to conduct more thorough risk assessments and due diligence when underwriting policies for businesses operating in environmentally sensitive industries.

- Offering specialized coverage for environmental liabilities and pollution incidents can help insurance companies address the specific risks associated with environmental factors.

- Collaborating with environmental consultants and legal experts can provide insurance companies with valuable insights to better evaluate and manage environmental risks for their clients.

Final Wrap-Up

As we conclude our exploration of Business General Liability Insurance in 2025, we reflect on the transformative trends and technological advancements that are reshaping the insurance landscape. Stay informed and prepared for the future by staying abreast of the changes in this critical aspect of business protection.

FAQ Guide

What are the key components covered by Business General Liability Insurance?

The key components typically include coverage for bodily injury, property damage, and advertising injury claims.

How is technology influencing the administration of Business General Liability Insurance?

Technology is streamlining processes, enabling quicker claims processing, and enhancing risk assessment in the insurance industry.

What environmental factors may impact Business General Liability Insurance in 2025?

Factors like climate change can lead to increased risks such as natural disasters, requiring insurance companies to adapt their policies accordingly.